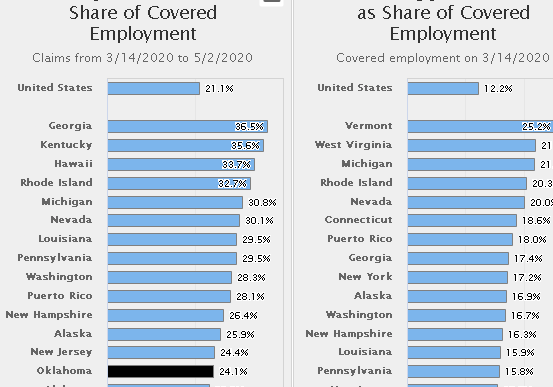

Oklahoma's post-pandemic recovery has been disappointingly slow relative to the nation. The state and both major metro areas have lagged well behind the U.S. in…

OK City Retail Trends Emerging

Overall state retail results are as bad as expected at this stage of the slowdown. State sales subject to sales and use tax are down 9.8% in the March/April/May period of 2020 vs. 2019. This is fairly consistent with our earlier expectations.

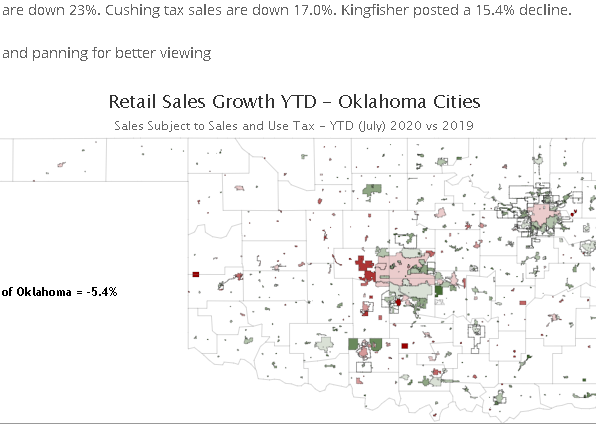

The map and data table below summarize combined sales subject to sales and use tax across Oklahoma cities in the three-month period of 2020 vs 2019.

There are several key regional trends emerging in the Oklahoma retail response :

- Biggest cities are the weakest. The state’s weak performance is closely tied to the state’s two largest cities. OKC taxable sales are down 9.6% in the three-month period. Tulsa sales are down 10.0%.

- Bigger cities weak too. Most other large cities posted weak results as well. Lawton is down 3.7%; Edmond down 0.5%; Norman down 7.0%; Stillwater down 8.2%. Some exceptions: Enid posted a 2.6% gain.

- City of OKC and suburbs weak. Nearly all municipalities in the OKC metro area have posted weak sales.

- Tulsa suburbs far outpacing city. In the Tulsa metro area, most suburbs have posted gains while the city of Tulsa has struggled. Several of the best performing cities among the 30 largest retail markets are Tulsa suburbs.

- Most cities have posted gains. Amazingly, 305 out of 516 reporting cities posted a gain in the three-month period in 2020 relative to 2019.

- Small cities shine. The best performing cities are all very small municipalities. More than 30 cities posted sales gains above 50% in the three-month period. Nearly 50 more posted gains between 25% and 50%.

- Several cities face severe financial distress. 130 cities posted a loss of 10% or more in the three-month period; 68 posted a loss of 20% or more; 41 posted a loss of 30% or more; 23 posted a loss of 40% or more.

- Some the state’s smallest cities face a financial catastrophe. In the three-month period, 15 cities posted a loss of 50% or more. All are very small cities.

*** The map allows zooming and panning for better viewing