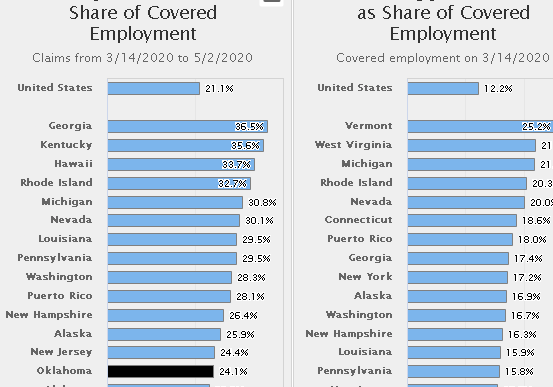

Oklahoma's post-pandemic recovery has been disappointingly slow relative to the nation. The state and both major metro areas have lagged well behind the U.S. in…

OK Municipal Retail Trends Improve Further

Retail sales across Oklahoma’s cities continue to improve.

State sales subject to both sales and use tax are down only 5.4% year-to-date through July of 2020 vs. 2019. The gap relative to 2019 has narrowed steadily since April.

July 2020 taxable sales are down only 0.9% compared to July of 2019.

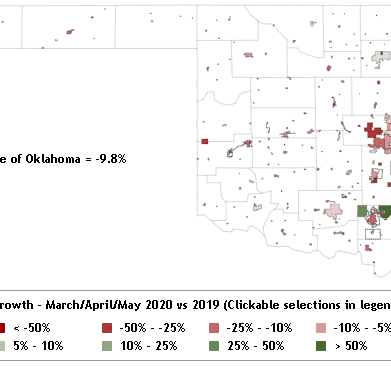

The map and data table below summarize combined sales subject to sales and use tax for all Oklahoma cities levying a sales or use tax in the year-to-date period through July of 2020 vs 2019.

Some key points include:

- OKC and Tulsa are showing resilience. Both cities are still weak relative to the prior year, but taxable sales are down only only a little more than 3% in each.

- OKC and Tulsa suburbs are generally stronger than the central cities. Most suburbs in both the OKC and Tulsa metro areas have managed to post a gain in taxable sales year-to-date.

- Tulsa suburbs continue to far outpace the city of Tulsa. Nearly every suburb in the Tulsa region has managed to post a gain in taxable sales year-to-date.

- The large suburbs in Tulsa are far outperforming the large suburbs in OKC.

- More than two-thirds of Oklahoma cities have now posted gains. Currently, 352 out of 516 (68%) reporting cities have a gain in taxable sales year-to-date in 2020 versus 2019.

- Several cities continue to face severe financial distress. 101 cities posted a loss of 10% or more year-to-date; 68 posted a loss of 20% or more; 38 posted a loss of 30% or more; 23 posted a loss of 40% or more.

- Several oil and gas towns continue to experience severe weakness. For example, El Reno taxable sales are down 48% year-to-date. Hennessey taxable sales are down 23%. Cushing tax sales are down 17.0%. Kingfisher posted a 15.4% decline.

*** The map allows zooming and panning for better viewing