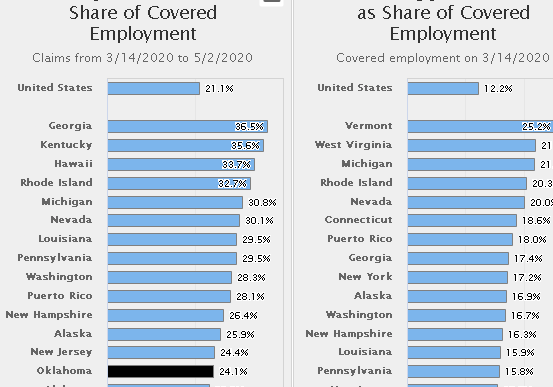

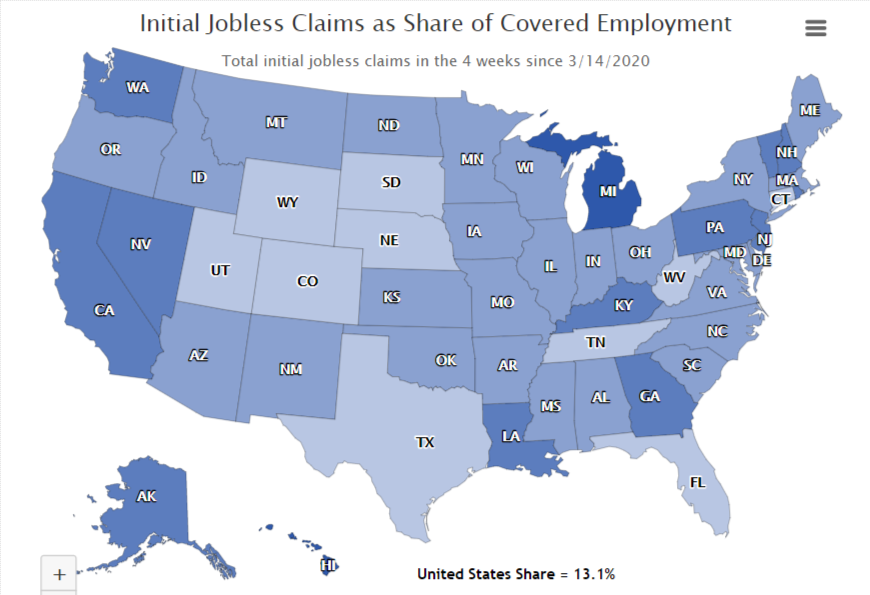

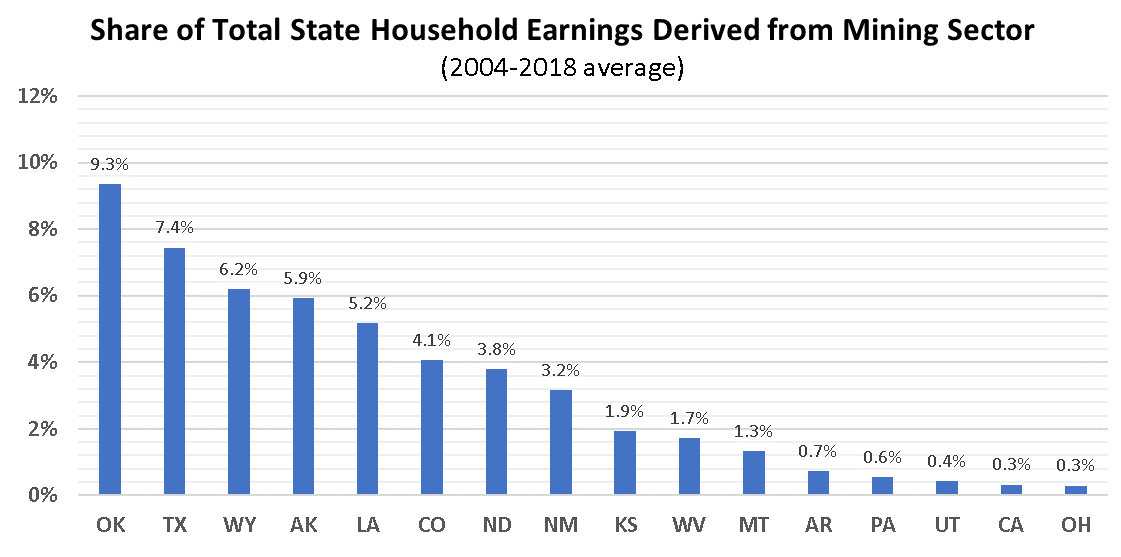

The Bad News You may be wondering where the good news is hiding given the string of bad news on Oklahoma unemployment claims so far…

Tax Exempt Tribal Retail Sales (2007)

Tax Exempt Tribal Retail Sales: An Economic Assessment of the Impact on Shawnee, Oklahoma

An economic assessment of Tribal Retail activity in the Shawnee Oklahoma region. The full report is available online.

Oklahoma’s Indian tribes are becoming an increasingly important component of state and local economic development and are expanding into most industry sectors, including the traditional retail trade sectors. While most efforts by tribes to expand local economic activity are generally viewed quite favorably, the tax-exempt nature of tribal owned businesses raises unique concerns for municipal government as tribes expand their presence in retail.

In Oklahoma, municipal governments are highly dependent upon the local sales tax to fund services (deriving an average of 40 percent of total revenues from sales taxes) and face the real concern that tribal retail expansion may redirect locally generated sales tax revenue to tribal governments and hamper their ability to provide necessary public services.

The purpose of this project is to assist municipal governments better understand the economic implications of the expansion of tax-exempt tribal businesses into the sales tax-producing business sectors. The study focuses specifically on the Shawnee, Oklahoma (Pottawatomie County) region, a market area shared by the city with five tribes, and one that is experiencing rapid expansion of tribe-operated businesses. The study is likewise designed to help tribes better understand the economic impacts they exert on the local economy by expanding in the tax-producing retail sector versus other industry sectors.