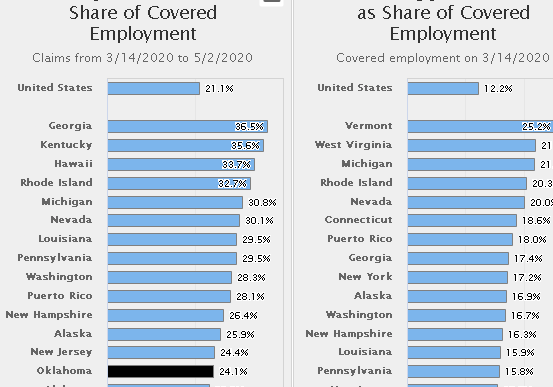

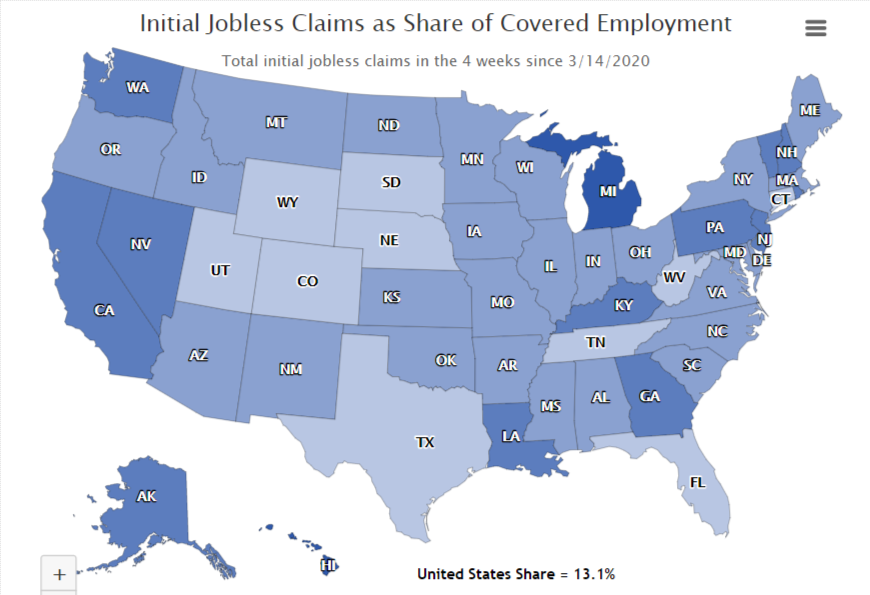

The Bad News You may be wondering where the good news is hiding given the string of bad news on Oklahoma unemployment claims so far…

Economic Assessment of Oklahoma Oil and Gas Tax Policy (2014)

The State Chamber of Oklahoma Research Foundation today released a RegionTrack research report titled “Economic Assessment of Oil and Gas Tax Policy in Oklahoma.”

The report provides an economic assessment of Oklahoma oil and gas tax policy and examines recent structural changes in the industry. The full report is available online for download. The report is intended to serve as a benchmark research document to assist state policymakers in fully evaluating the economic role of the industry and any potential effects that changes in state tax policy may produce.

As has been widely discussed, the oil and gas industry is undergoing rapid growth and transformative change, both in Oklahoma and across the nation. The extent of this change and the effects on the industry and the energy producing regions of the country are not widely understood. This makes it particularly challenging for policymakers who must establish the tax policy that governs the industry’s activities.

For policymakers, the changing environment for oil and gas makes balancing the need for revenue with the desire to foster growth in the state’s trademark industry more challenging than ever. The oil and gas industry remains the largest single source of state tax revenue, and important shifts have taken place in the types and amounts of taxes paid by the industry. The channels of economic influence on the state economy have also changed as ownership and investment in the industry are now equally important as employment and wages as a source of economic stimulus.

The study addresses five basic questions:

1. What are the goals and objectives of current state tax policy toward the oil and gas industry? This includes examining the structure of current state tax provisions on oil and gas.

2. Is there a sound economic basis for encouraging oil and gas drilling activity in the state? Are there clear economic payoffs to stimulating drilling activity?

3. What are the economic costs and benefits of providing severance tax relief to the industry? We provide an analysis of the current costs and benefits of existing tax policy as well as the policy in other states competing for the same activity.

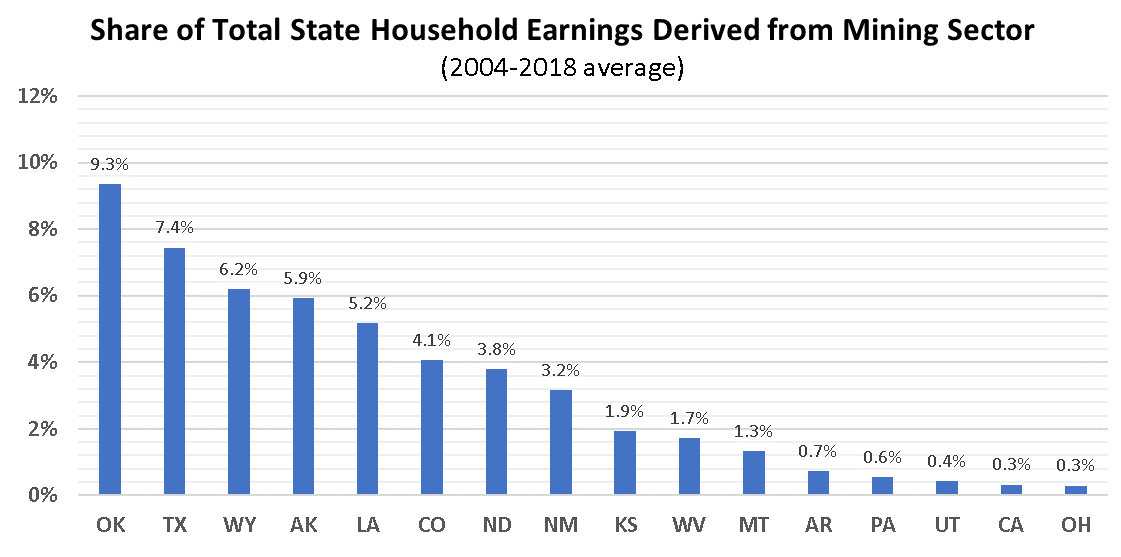

4. To what degree is the overall state economy tied to the economic health of the oil and gas industry? Or, to what degree is Oklahoma still an energy state?

5. Are there spillover economic benefits to the state of tax policy that encourages growth in the oil and gas industry? We examine many of the visible changes in the Oklahoma economy associated with the reemergence of the industry the past decade.

Top Economic Facts about Oklahoma’s Oil and Gas Industry

1. Renewed growth in Oklahoma’s oil and gas industry has greatly enhanced the strength and competitiveness of the state economy.

The state’s trademark industry has roughly doubled in size the past decade. This growth has contributed to faster state employment growth, a surge in population, income gains relative to the nation, strong rural growth, and significant tax revenue to the state.

2. The oil and gas industry continues to have an outsized influence on overall state economic activity.

Oil and gas firms account for only 3.2% of all business establishments but hire 5% of wage and salary workers, produce 10% of state GDP, and generate 13.5% of total earnings statewide.

3. Oil and gas served as the state’s key job engine the past decade.

Between 2002 and 2012, Oklahoma oil and gas firms created 29,000 new wage and salary jobs while all other private industries combined added only 56,000.

4. Oil and gas drilling is the largest source of private capital spending in the state.

Capital spending on oil and gas drilling activity totaled an estimated $11.7 billion in 2012. This is equivalent to the construction of nearly 67,000 new single-family homes annually valued at $175,000 each.

5. The oil and gas industry is the largest source of state tax revenue in the state.

Oklahoma oil and gas firms, owners, and employees paid direct state tax payments of nearly $2.0 billion in 2012, or 22% of all state taxes. Severance tax payments to the state the past ten years totaled $8.69 billion after rebates, or $869 million annually.

6. Oklahoma is the only major energy state to experience a strong rebound in both crude oil and natural gas production in recent years.

State oil production has nearly doubled since early 2010 to an annual rate of 119 million barrels. Natural gas production is up nearly 40% to 2.2 trillion cubic feet annually.

7. Oklahoma remains a Tier 1 energy state with an economic cycle highly influenced by activity in the oil and gas sector.

The energy sector provided the state economy with a significant economic cushion during the recent national recession and has boosted the overall rate of state economic growth the past decade.

8. Growth in the oil and gas industry has pushed migration into the state to its highest levels in three decades.

More than 118,000 new residents relocated to Oklahoma between 2002 and 2012, more than three times the rate experienced from 1991 to 2001. Recent state population growth exceeded 1% annually for the first time since the early 1980s.

9. Strong earnings gains in the oil and gas industry have propelled Oklahoma per capita income to 96% of the U.S. level.

Oklahoma personal income per capita is up from 85% of the national average only a decade ago. The gains are largely traced to the performance of the oil and gas industry.

10. Oil and gas activity forms the core of entrepreneurial and investment activity in Oklahoma.

Nearly 40% of all income produced by proprietors and partnerships statewide is derived from the oil and gas industry. Most of the largest and best-performing public companies based in the state are in the energy industry.

11. Oil and gas is driving much of the economic growth in the non-metro areas of the state.

Oil and gas activity is having a transformative effect in many smaller, non-metro areas of the state. In the recovery years of 2010 through 2012, job growth in the non-metro energy-producing counties totaled 5.3% versus only 1.1% in the non-energy counties.

12. Oklahoma is home to the second largest concentration of oil and gas activity in the U.S.

Other than Texas, Oklahoma has the highest number of oil and gas wage and salary workers and proprietors and the highest total earnings from the oil and gas industry.

13. Energy states continue to enjoy faster long-run job growth than non-energy states.

Since 1965, Oklahoma has added roughly 20% more jobs than the average of the non- energy producing states. Every energy state except West Virginia has outperformed the non-energy states in job growth since 1965.

14. Spillover effects from oil and gas are driving economic activity in other Oklahoma industries.

Oklahoma oil and gas firms made an estimated $22.1 billion in purchases in 2011, of which $10.2 billion was spent within Oklahoma.