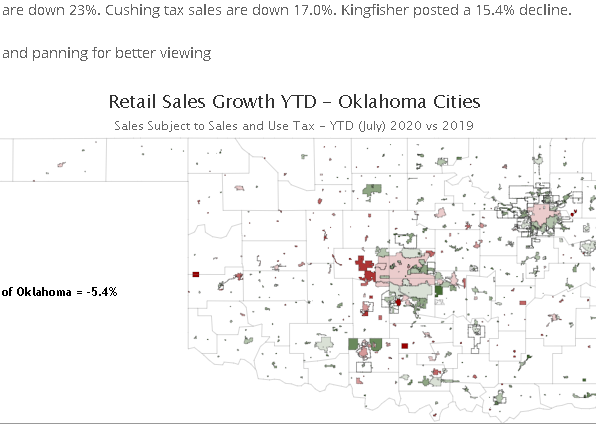

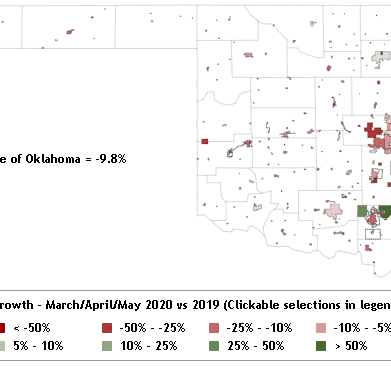

Oklahoma's post-pandemic recovery has been disappointingly slow relative to the nation. The state and both major metro areas have lagged well behind the U.S. in…

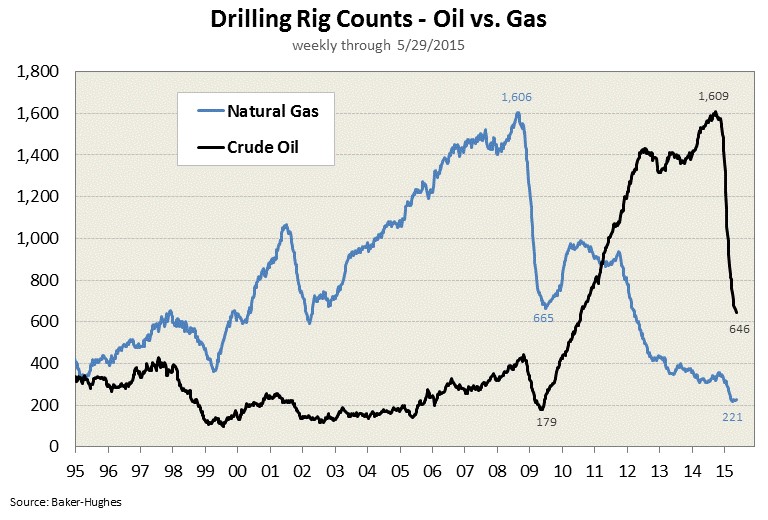

Oil Rig Drop Now Exceeds 2008-09 Nat Gas Rig Collapse (06/03/2015)

The ongoing drop in the number of drilling rigs searching for crude oil now exceeds the collapse in natural gas rigs suffered back in the 2008-2009 period. Our pic of the week illustrates the similarity in size and pace between the respective oil and gas drilling collapses. Crude rigs are off by 60% in the 33 weeks since October 2014, from a high of 1,609 to only 646 currently. Natural gas rigs similarly dropped 59% from a peak of 1,606 to to only 665 over a period of 45 weeks in late 2008 and 2009.

It is not yet clear how close we are to a short-run bottom in the crude rig count. Most major producing areas continue to see slowly declining crude rig counts.

The prior collapse in rigs on the natural gas side may provide a clue to the next move in crude drilling. Natural gas drilling managed to pick up only after a substantial rebound in natural gas prices from below $3/mcf to $6/mcf. The more troubling dimension of the natural gas story is the subsequent decline since 2011 to only about 225 natural gas rigs currently. We discovered along the way that current domestic natural gas demand can now be met with only about 200-400 active rigs and a market price for natural gas in the $2.75-$4.25 range. Unless increased LNG exports come to the rescue of the industry in 2016, the outlook for natural gas drilling is likely to remain unchanged in the near- to intermediate-term.

The natural gas experience also suggests that crude oil prices may need to move well above the current $60 range to trigger another sustained increase in drilling activity. It further suggests that a quick return to anything close to recent peak drilling activity seems highly unlikely. The 15%+ annual crude oil production gains driven by that level of drilling activity are simply well in excess of demand growth. Much like natural gas, increased exports of crude oil appear to be a pivotal factor in reviving U.S. crude oil exploration in the near term.

Sign up to receive RegionTrack’s PIC OF THE WEEK!

[email_link]