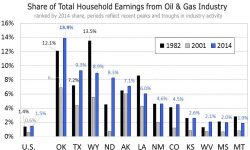

Which States are Most Dependent Upon Oil and Gas Activity?

Currently, Oklahoma has the distinction of having the largest share of total household earnings* coming directly from the oil and gas industry – an astounding 13.9% for all of 2014. In fact, Oklahoma now has the highest share ever posted by a state in the modern energy era, with Wyoming’s 13.5% share in 1982 ranking a close second.